Inspire. Inform. Involve.

At TakingITGlobal, we design and deliver youth engagement programs that empower young people to understand and act on local and global challenges.

At TakingITGlobal, we design and deliver youth engagement programs that empower young people to understand and act on local and global challenges.

Our mission is to shape a more inclusive, peaceful and sustainable world through educating and empowering youth across the world to learn and engage on social issues. We achieve this through three program areas:

Our programs serve youth, educators and organizations in their individual and collective efforts to create solutions for the world's greatest challenges.

Granted to youth-led service projects!

To truly empower young people to become agents of positive change in their local and global communities, we recognize that everyone has a role to play. We provide engaged youth with funding and opportunities to participate in and become key stakeholders in strengthening global and local social movements.

The Sprout Ideas Fellowship is a 10-month guided skill-building experience from April 2023 to January 2024 offering 250 #RisingYouth Alumni training, mentorship, seed grants and an opportunity to fundraise in support of a volunteer-led project.

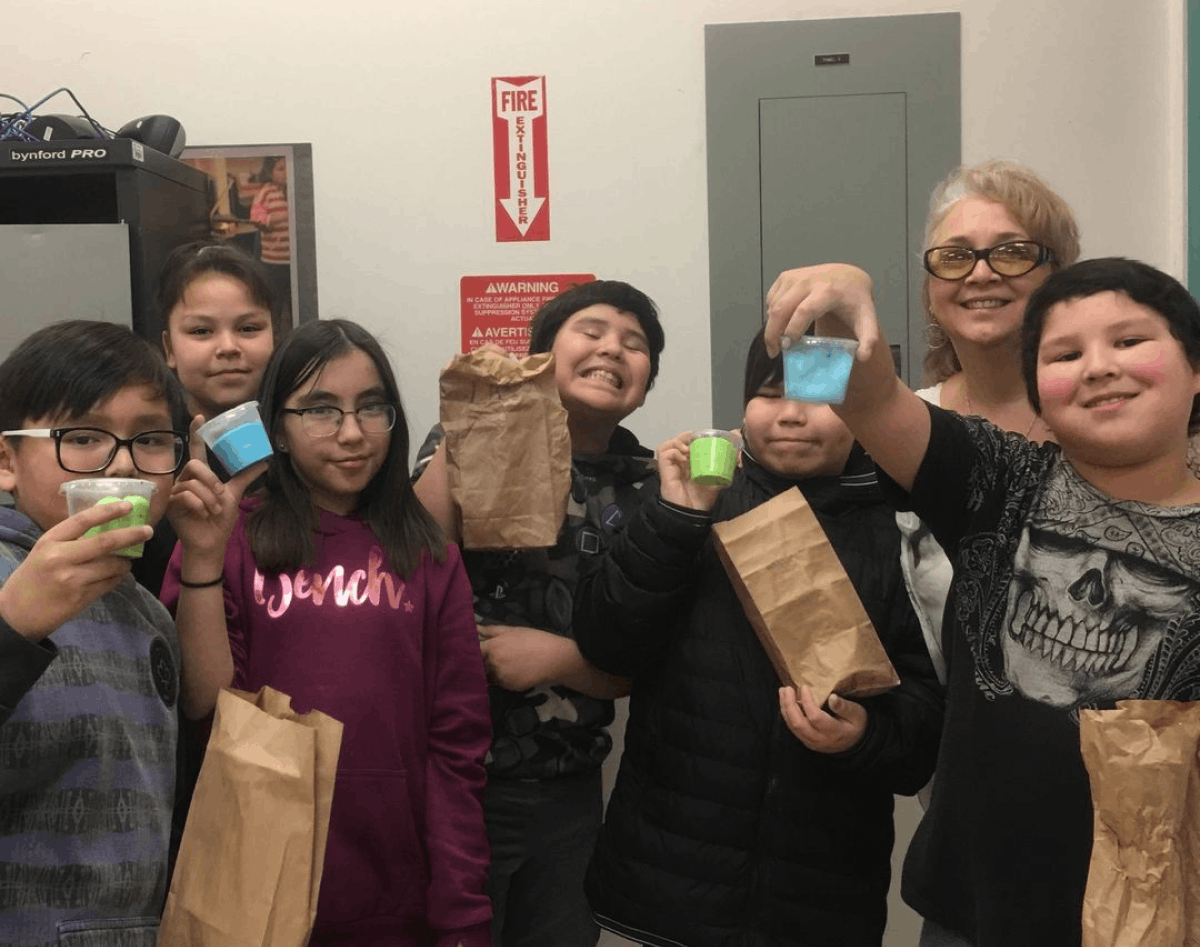

Learn MoreThe Samuel Connected North Youth Leadership Fund was established to support emerging Indigenous youth leaders in creating meaningful change within and beyond their communities.

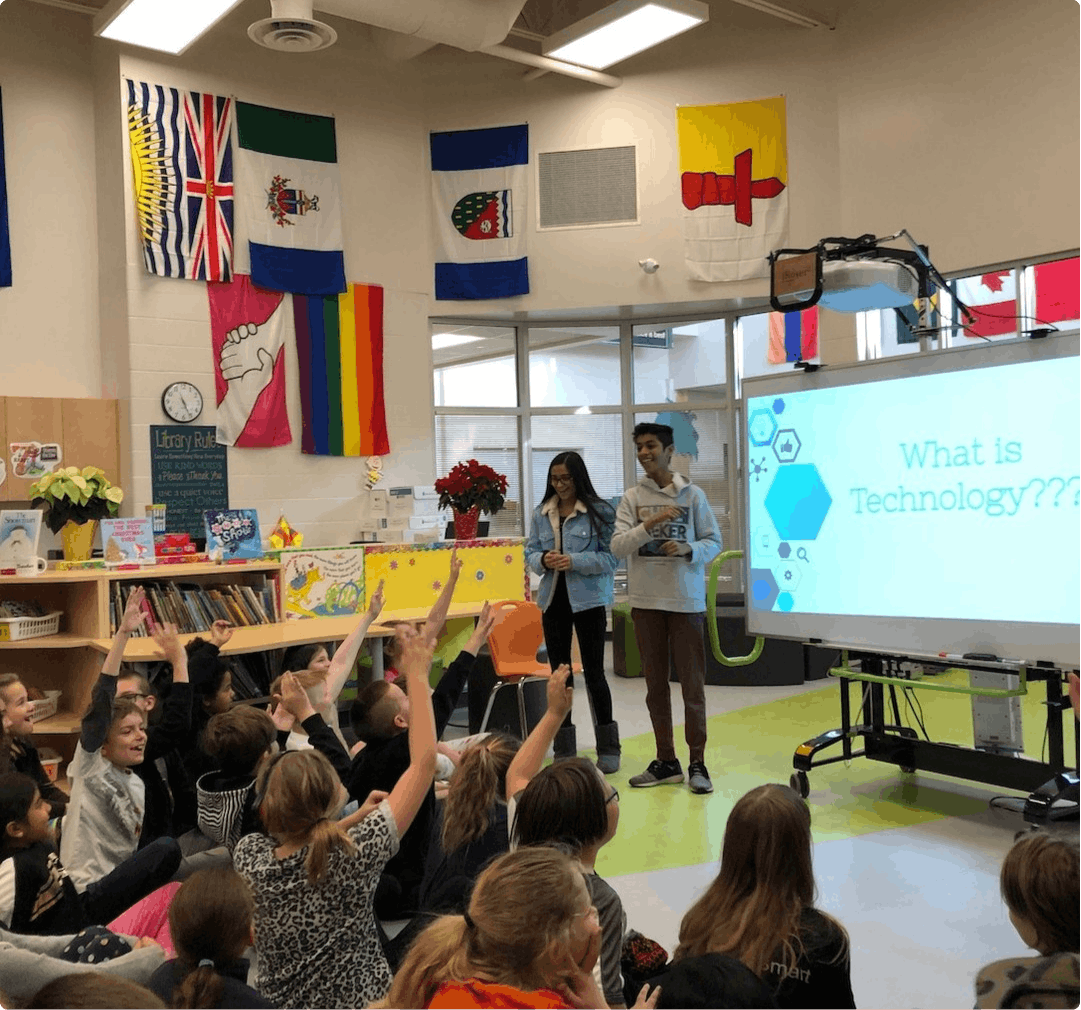

Learn MoreOur programs are delivered to even the most remote areas to facilitate interactive learning experience that drive student engagement. Youth connect with peers and experts around the globe while educators also receive professional learning experiences and resources.

Connected North fosters student engagement and enhanced education outcomes in remote Indigenous communities, delivering live and interactive learning experiences through high-definition video technology.

Learn MoreTogether with the Centre for Global Education, Global Encounters brings the world to a classroom and a classroom to the world by giving students the opportunity to hear from global experts on the people, places, and topics they are learning about in their curriculum.

Explore Upcoming EventsMinutes of interactive learning delivered

Students reached with digital skills training

With textbooks, teacher’s guides and web platforms, we offer programs that make content as accessible and widely distributed as possible. We collaborate with artist to develop resources that teaches youth digital skills while inspiring them to explore their creativity as they take on social justice issues and innovation.

Your Voice is Power is a learning experience and coding competition. Students learn about activism, music, computer science, and social justice by remixing songs from Indigenous artists on the EarSketch coding platform.

Explore the ProgramCreate to Learn offers hundreds of free, self-paced training videos for youth to build digital skills and foster creativity and entrepreneurship. Lesson plans help educators integrate these training sessions across the curriculum.

Browse the VideosWe believe in investing in young people to invest in their own ideas. We find new and easier ways for young people to participate.

Become a changemaker by signing on commitments, keep track of your progress & get inspired to take action with a like-minded global community.

Take ActionOur Guides to Action are designed to help you turn your ideas and dreams into reality. These guides are workbooks for you to download, use and share.

Download the GuidesWe have an extensive database of publications from around the world, including youth input to policy processes we've supported. Explore toolkits, articles, research, and much more!

View ToolkitsThe Global Gallery is a platform for artistic expression which raises awareness through the arts, promoting cross-cultural understanding and dialogue around major global changes.

Internationally Recognized Days promote issues of international interest or concern. TakingITGlobal invites you to join millions of people worldwide in the observance of these days.

Teachers have the ability to empower your students to shape a better world. Join the over 17,000 teachers bringing these programs and opportunities to your classroom!

With many resources available, we support teachers worldwide to use technology to facilitate transformative global learning experiences.

View Teacher Resources

Thousands of students across the country and around the globe are directly impacted by the programs we offer. Supporting these programs brings unique learning opportunities to students who otherwise would lose out.

It is with respect, humility and kindness that our team would like to acknowledge the land that nourishes us.

We acknowledge our interconnectedness and are thankful for the water that flows and life that grows each day. Our organization is comprised of a team from many diverse backgrounds who are situated on Indigenous lands across many First Nations, Inuit and Métis communities. In this context, we approach our work with a shared responsibility in upholding treaty agreements and awareness of the ancestors who have come before us, along with the impact of our efforts for generations to come.

TakingITGlobal is a partner in the creation of Whose.land, a learning resource and mobile app to highlight Indigenous Nations, territories, and Indigenous communities. It includes educational videos, lesson plans, and provides a starting point for conversation between Indigenous and non-Indigenous citizens about land, territorial recognition and land acknowledgement.

-svg.jpg?ixlib=gatsbyFP&auto=compress%2Cformat&fit=max&w=717&h=350)